Clients can pay you directly through their invoice.

#Wave bookkeeping free free#

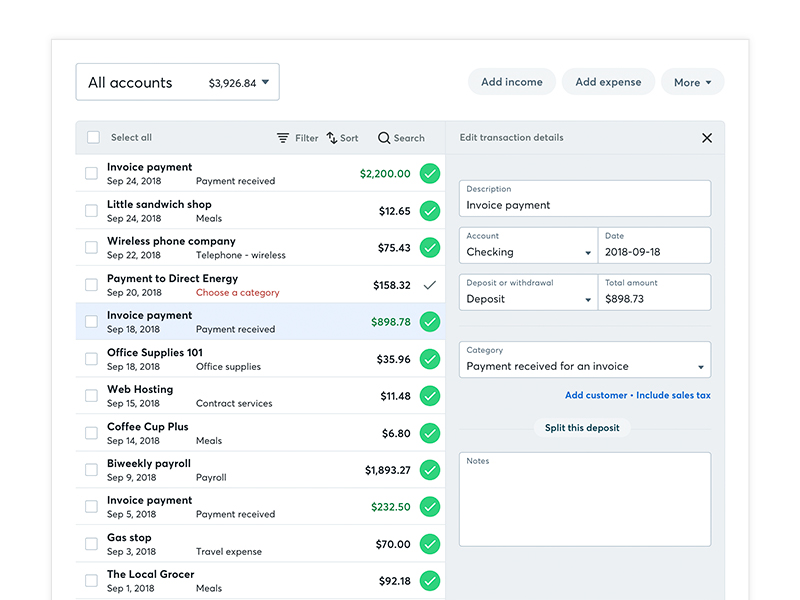

We love that even though Wave is free and freelance-focused, it doesn ’t assume freelancers can afford to skimp on financial accuracy.įinally, Wave ’s billing, payment acceptance, and invoicing features all work together to ensure you get paid on time.

#Wave bookkeeping free software#

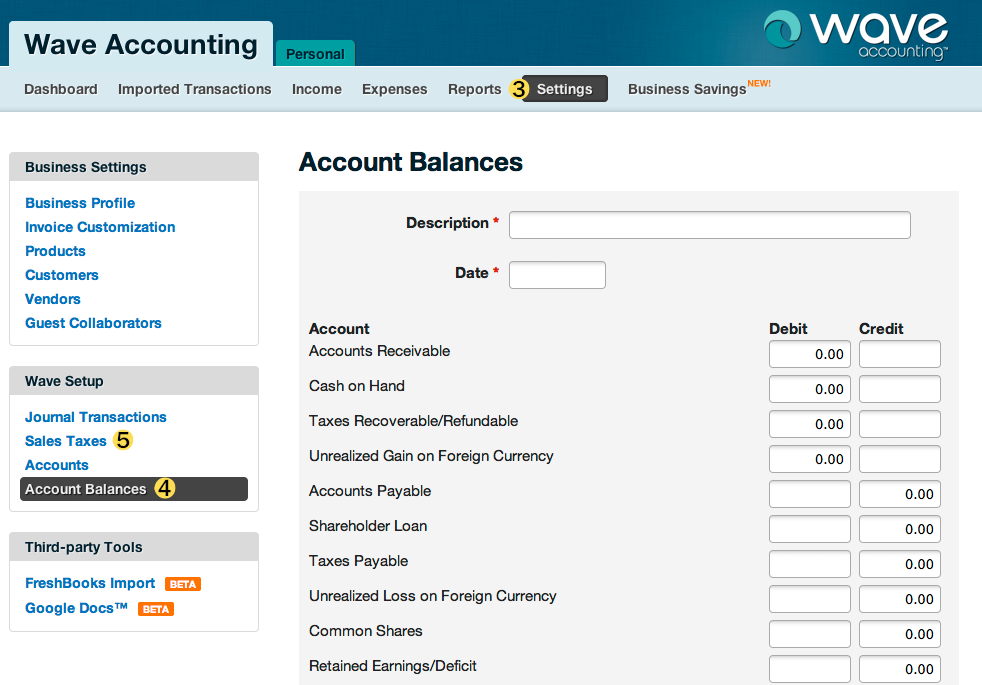

Most accounting software use the double-entry system, though FreshBooks ’ cheapest plan is a notable exception. Wave Accounting also uses double-entry accounting, which is much more accurate than basic single-entry accounting. For instance, its unlimited invoices are much more customizable (and, in our opinion, more professional-looking) than QuickBooks ’ comparatively expensive invoices. You can also customize your chart of accounts (CoA) to include only the accounts you need-useful for freelancers, who tend to have fewer expense and income categories on their books than bigger businesses. We ’ve already hit on a few accounting features that set Wave apart, but there are a few more perks to cover.įirst, Wave is remarkably customizable-especially considering that it ’s, you know, free. But for small-business owners who want to eventually expand their businesses and hire an employee or two (or more), just know that Wave doesn't make it easy to add payroll software beyond its own. Of course, if you freelance, you don’t need to worry about running payroll either now or in the future. It ’s a fine payroll product, both in terms of features and price, but it ’s definitely not the best payroll bargain out there (that ’d be Gusto, OnPay, or QuickBooks Payroll). If you want to integrate your Wave Accounting software with payroll, you have to choose Wave ’s own product: Wave Payroll. Most importantly, it doesn ’t sync with any third-party payroll providers. Wave also doesn ’t have quite as many integrations as other paid (and more popular) accounting software options.

It also recently got rid of its receipt-scanning app: now, the only Wave app is its invoicing app-which is fine and functional, but nothing to write home about (unlike, say, FreshBooks ’ stellar invoicing app). Unlike with QuickBooks, you can ’t manage 1099 contractors with Wave (which is one reason Wave ’s better suited to 1099 contractors rather than those who employ them).Īnd in contrast to just about every accounting software provider at this point, Wave doesn ’t have a mobile accounting app. For instance, it doesn ’t offer the same built-in time-tracking and project-tracking features you get with most other basic accounting software plans. Wave Accounting does a lot for the price-but it can ’t do everything. If you have multiple Etsy, eBay, or Amazon shops or work a few different freelance gigs, you can keep each business ’s income and expenses separate. Wave also lets you manage multiple businesses under the same Wave account. And FreshBooks doesn ’t limit your user number, but it does charge an extra $10 a month per user-which adds up fast.

QuickBooks Online limits user numbers by plan (its cheapest plan, QuickBooks Simple Start, includes just three users). For instance, Xero only includes expense tracking with its priciest plan, which starts at $65 a month. Honestly, these features outpace those included with some paid accounting software.

0 kommentar(er)

0 kommentar(er)